Severance and Ad Valorem

Introduction

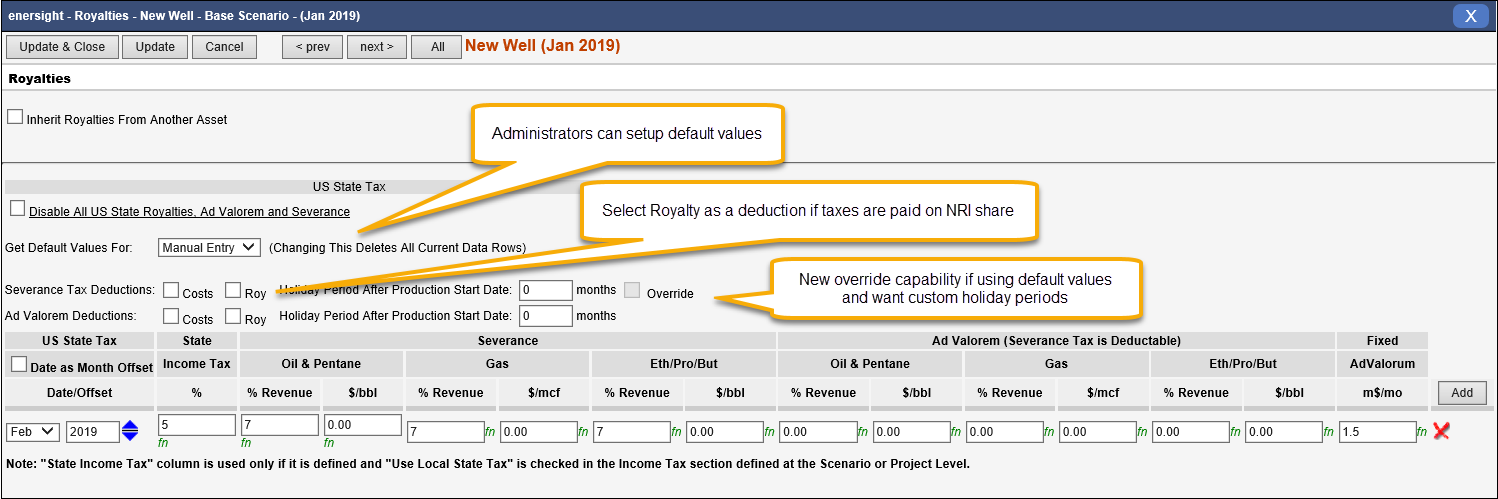

The Royalties dialog box is used to enter severance and ad valorem taxes. This box may be relabeled at the company level and so alternatively may be named Sev & Ad Val, Economics or Fiscal Regime or some other variation for your company.

Click image to expand or minimize.

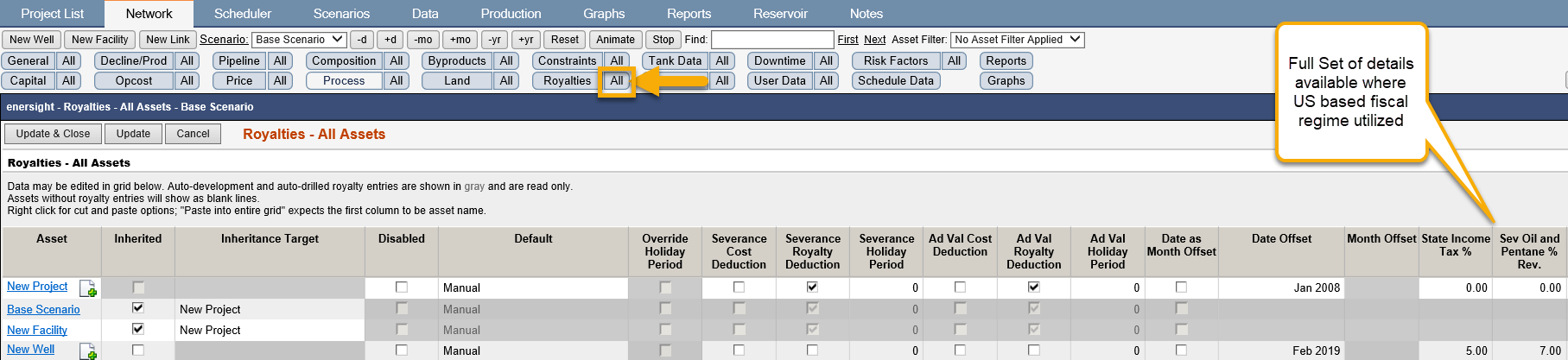

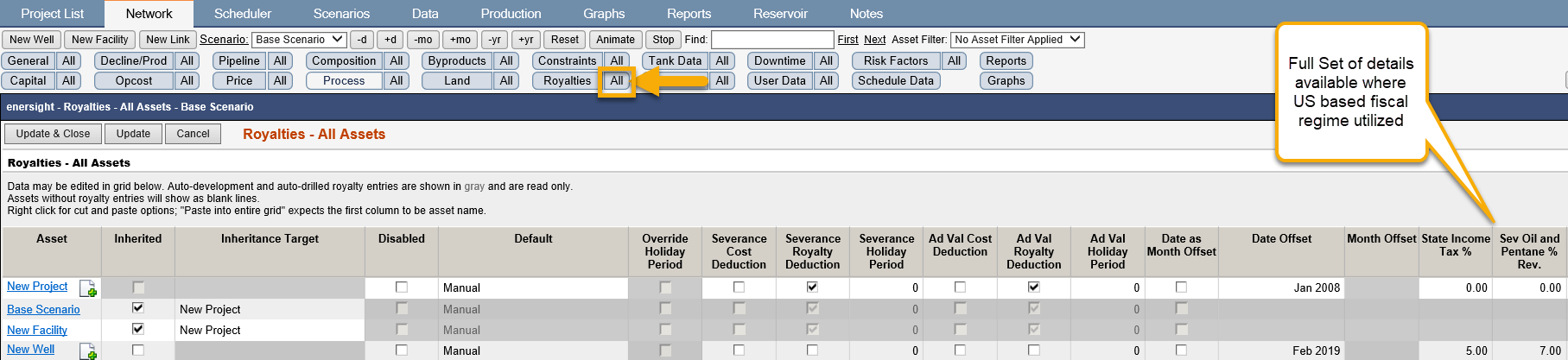

The full set of details may also be viewed via the All button where direct edits and copy/paste functionality is available.

Click image to expand or minimize.

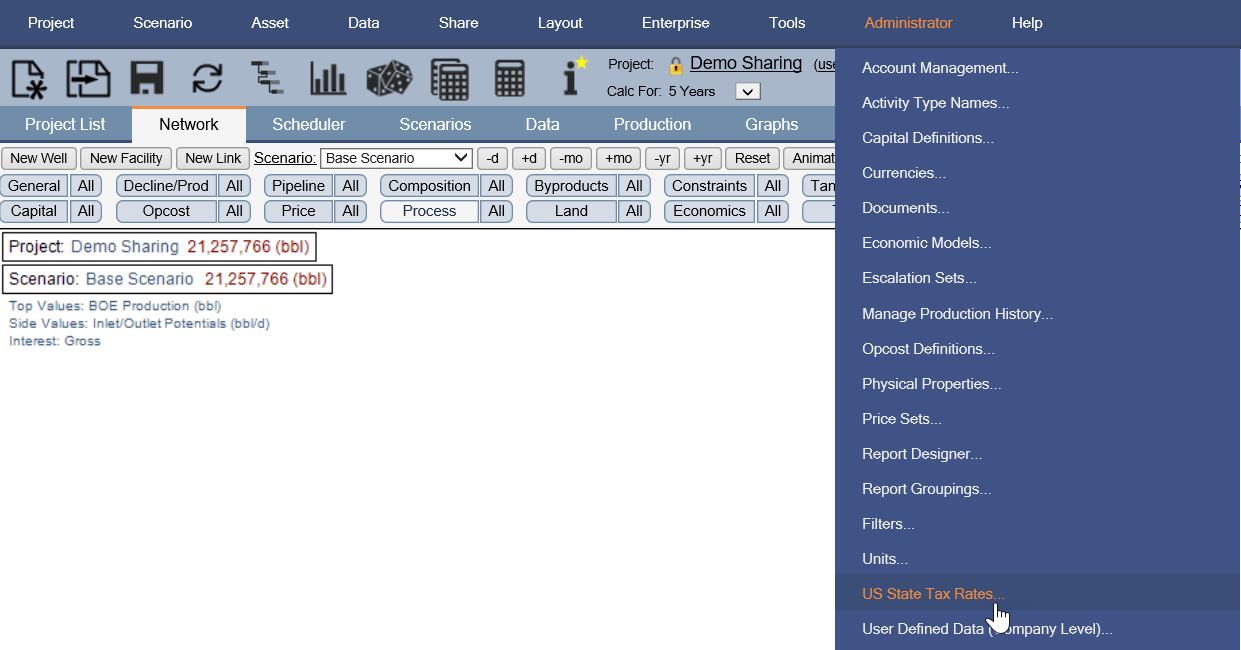

The company level state tax definitions may be accessed via Administrator/US State Tax Rates.

Click image to expand or minimize.

Detailed Option Descriptions

US State Tax

Get Default Values For: Allows you to select a predefined set of values for severance and ad valorem rates. Your administrator can add to the list of predefined items.

Severance Tax Deductions & Ad Valorem Tax Deductions

Costs: This will subtract the costs for Liquids or Gas from the revenue before applying the % Revenue rates. This has NO EFFECT on the $/bbl and $/mcf based tax payments.

The check boxes in the Operating Cost and Capital Cost Definition editors, which define whether a type or class is deductible, are not applicable to US Royalty models.

Royalty: This will subtract the royalty volumes or values from the tax payments. This applies to both the % Revenue and volume based rates. Select this if you pay only your NRI share or the taxes.

A new override for both holiday periods is now available to assist in being able to set up meaningful default values while retaining well-specific holiday periods.

Severance and Ad Valorem Tax Rates

% Revenue | Oil & Pentane | This is applied to the wellhead Oil and Pentane+ Revenues. Pentane+ is assumed to be condensate and hence treated as liquids. Both the Deduction of Costs and Deduction of Royalty affect these numbers. The Pentane+ must be defined in the ByProducts Dialog of the well for it to be included here. If it is defined in the Gas Composition dialog, then it is assumed to be part of the wet gas stream and is taxed as gas. |

Gas | This is applied to the wellhead Gas Revenues. Both the Deduction of Costs and Deduction of Royalty affect these numbers. The heating value defined by gas composition does affect this number through reduced or increased value ($/mcf price), so any inert gases are excluded in this manner. |

Eth/Pro/But | This is applied to the wellhead Ethane, Propane, and Butane Revenues. Both the Deduction of Costs and Deduction of Royalty affect these numbers. The Ethane, Propane, and Butane must be defined in the ByProducts Dialog of the well for it to be included here. If it is defined in the Gas Composition dialog, then it is assumed to be part of the wet gas stream and is taxed as gas. |

$/bbl | Oil & Pentane | This is applied to the wellhead Oil and Pentane+ Revenue. The wellhead Pentane+ volume is defined in the ByProducts dialog of the well. The gas composition has no effect at the wellhead other than defining the heating value. This value is affected by the Royalty Deduction option, but is not affected by the Costs Deduction option. |

Eth/Pro/But | This is applied to the wellhead Ethane, Propane, and Butane Revenues. The wellhead Ethane, Propane, and Butane volumes are defined in the ByProducts dialog of the well. The gas composition has no effect at the wellhead other than defining the heating value. This value is affected by the Royalty Deduction option, but is not affected by the Costs Deduction option. |

$/mcf | Gas | This is applied to the wellhead Gas Revenue. The wellhead Ethane, Propane, Butane, and Pentane+ volumes defined in the ByProducts dialog of the well are not included as part of the Gas volume. This value is affected by the Royalty Deduction option, but is not affected by the Costs Deduction option. |